There was a time when going to the bank for anything meant spending a minimum of half your day. From standing in one queue to another to getting tangled in complicated legacy systems. Banking was definitely not for the faint-hearted.

But that is old news, the ways of banking have changed, and online banking has made life much easier.

One of the most reliable agents in digital banking is a conversational chatbot. They single-handedly solve the eternal problem of customer interaction with a bank.

How?

Conversational chatbots are programmed and trained in Natural Language Processing (NLPs) which allows them to facilitate a 2-way communication between the customers and the bank using machine learning and artificial intelligence.

Here is a breakdown of how banking chatbots to aid customer engagement in the banking sector.

What are chatbots for banking?

Chatbots for banking are essentially conversational chatbots deployed by banks to enhance customer experience on all digital banking platforms. Banking chatbots help improve customer engagement and ease legacy processes, making banking more accessible in this fast-paced, busy era.

Pain points of the Banking Industry

Chatbots have aided all industries in one way or the other. To understand the problems that chatbots solve in banking, let us first address these gaps and shortcomings.

- Long waiting times: Banking processes are lengthy and, more often than not, require a lot of patience.

- Inconsistency in information: 41% of customer support representatives give varying responses.

- Unanswered questions: 34% of customer service executives cannot solve queries due to a lack of information or loss of words.

- Missing information: 31% of the time, users are unable to locate the answers on the website.

- Increase in applications: there is an exponential increase in the number of new applications.

Benefits of AI chatbots in banking

Now that we have the problems laid out let's talk about how AI chatbots for banking affect them.

Cost-effectiveness

According to statistics, banking agents save 4 minutes of their time for every query handled by a chatbot. This saves up to 0.70 USD per query. This is because Al and ML-based chatbots are self-updating. Once they are installed, they use the provided data to solve multiple customer queries simultaneously while collecting more data from customers to update information and improve the quality of service. This makes them extremely cost-effective.

Engaging and retaining customers

Conversational chatbots use NLP to converse with customers. They also use the conversational format to collect more customer data and use them to personalise engagement. Chatbots in banking help answer customer queries quickly, streamline legacy processes, send updates and notifications, build customer profiles and provide recommendations based on those profiles. This improves the overall customer experience, resulting in the retention of customers for the long term.

Streamlining banking operations

Chatbots act as personal financial assistants. They give financial advice by tracking the financial market and the customer's expenditures, give pending payment reminders and automate scheduled payments. Banking chatbots are also capable of streamlining banking processes that would ordinarily take multiple hours and paperwork to complete. From opening a bank account to providing balance information, assisting in simple transactions, giving debit and credit card reports, accessing specific bank details, and so much more. This makes banking more efficient and appealing to all customers.

Improving overall efficiency

AI chatbots can help educate and simplify banking for consumers by providing necessary information and being available 24/7 to answer frequently asked customer queries. In this process, chatbots collect and update customer data that gets assorted and stored to personalise interactions, streamline processes, recommend and sell products, give financial advice and create a customer profile for further reference. This helps save time and money, increase company data, improve employee efficiency and retain customers.

Key features of Chatbots in Banking

AI chatbots in Banking must include certain features to fit the bill. These features are simple and cover 5 essential factors.

- A chatbot must be conversational. Personalised conversations help feel more reliable than robotic one. Since chatbots act as financial advisors, they need to have that human touch so the customers are not out off.

- Chatbots should be transactional. Banking chatbots should be able to perform certain banking functions to be a sufficient investment. This involves aiding in opening a bank account, transferring funds, providing details and connecting the bank's front-end to its back-end to facilitate smooth operations.

- Monetary and transactional transactions can leave no room for error. Chatbots in banking need to be reliable and precise to avoid mistakes in interpreting messages and initiating incorrect transactions, which could lead to loss of customers.

- Data privacy and security are the two most important aspects of banking. A banking chatbot must maintain and protect retrieved data's confidentiality to ensure that only authorised personnel can access it.

- Customers use multiple devices and access multiple accounts on social media. It is essential for banking chatbots to be available on most platforms to help educate and initiate easy banking via all channels.

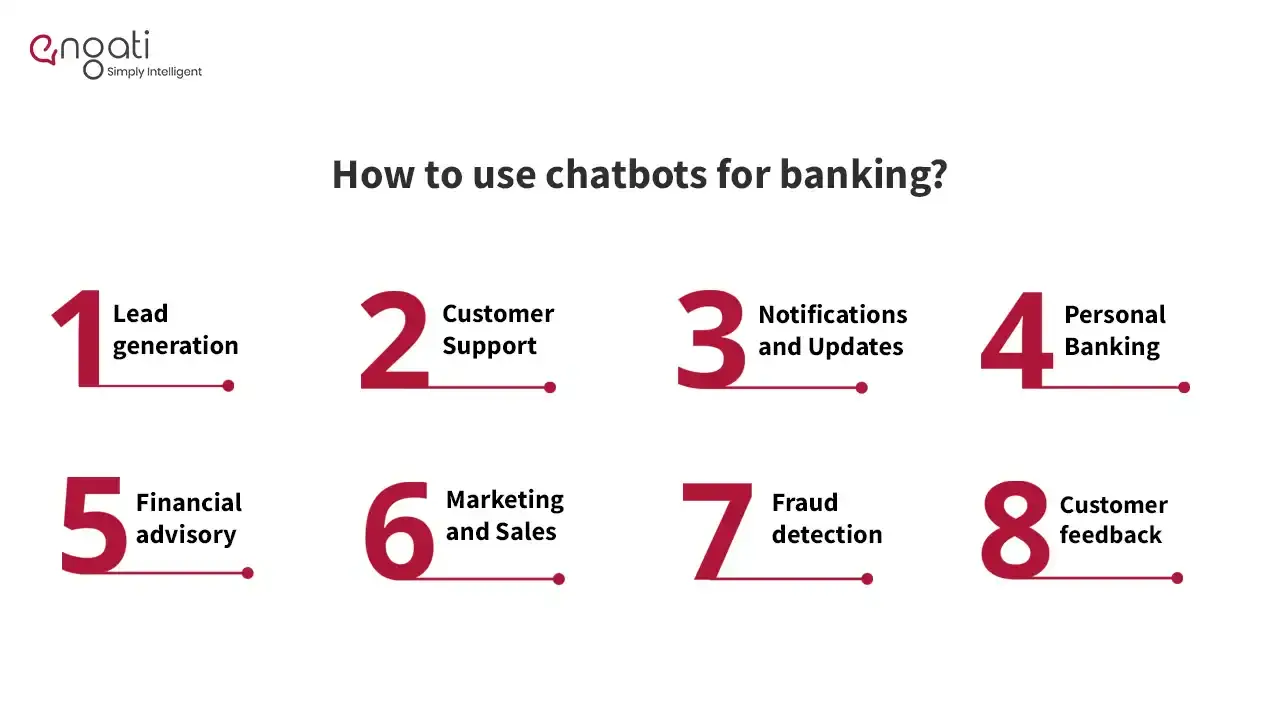

How to use chatbots for banking?

One can only make the most out of AI chatbots in the banking industry if one knows how to use them.

Here are some use cases of AI chatbots that will truly help you reap their benefits.

Lead generation

Chatbots are the best source for lead generation. They can seamlessly collect customer data right from the very first conversation and build on interactions by using the acquired information for a conversational advantage. This way, by understanding the needs and requirements of users, banking chatbots can use real-time, personalised interactions to reach new customers directly and also get their details for the sales teams if required.

Customer Support

AI and ML-supported chatbots have completely revolutionised customer support, especially in the banking industry.

These conversational chatbots use Natural Language Processing(NLP) to understand customer queries using specific keywords and answer accordingly easily. By automating FAQs and replies via chatbots, banks can be available 24/7 and answer most customer queries in real-time, especially repetitive questions about the bank information or banking processes.

Notifications and Updates

Chatbot in banking can send timely notifications for transactional updates, payment reminders, bank offers, policy offers, and more. Chatbots can inform customers directly about the preferred communication channel and help build a rapport between the customer and the bank.

Personal Banking

Chatbots can be used for a variety of banking processes, like collecting and processing data and documents, creating and managing customer accounts, providing account details and balance information, reducing the impending wait time and paperwork by using existing data to automate processes for clients, doing KYC processes, making and receiving payment transactions, etc. By automating these processes, the bank makes their work easier while simultaneously improving the overall banking experience.

Financial advisory

AI chatbots in the banking industry can be used as virtual financial advisory assistants.

Chatbots can keep track of user's spending habits and account balances. They keep this information secure and use it to give valuable financial advice to users, including set spending limit reminders, payment reminders and bits of informational advisory for education and habit development.

Marketing and Sales

AI marketing chatbots can also be used for marketing and sales purposes. Chatbots can use digitised marketing techniques to attain new customers and retain old ones. They can send offers and information on different initiatives to customers, collect their data in conversation, use the information to create customer profiles, use customer data to personalise conversations and customer engagement, recommend and upsell products based on customers' needs and much more.

Fraud detection

Customers trust banks and financial institutions with their hard-earned money. Hence, it is the bank's responsibility to take every precaution to protect it. Chatbots help customers keep track of all transactions by sending them timely notifications. They also notify of suspicious activity or transactions initiated on the account and help in the event of a hacked account.

Customer feedback

Banking chatbots like any other can be used to reach out to customers and seamlessly collect their personal reviews and feedback in conversation. This information can then be used to improve service and help retain customers for life.

Here are some use cases of chatbots in Banking

Qatar Insurance Company

One of the major BFSI companies, Qatar Insurance Company (QIC), uses an Engati chatbot to generate quotes, renew policies, manage claims and answer

Queries. This in turn has helped increase customer engagement, drive sales, and create amazing customer experiences.

Check out their video testimonial.

XAC Bank

XAC Bank is a leading banking and financial services company based in Mongolia. XAC launched an Engati messenger bot that attends to multiple users simultaneously and provides human assistance, the bot also captures and sends users' concerns via emails to further streamline the user experience.

It helps the bank engage customers at a large scale and answer all their banking-related queries 24x7.

HDFC Capital

HDFC Capital Advisors Ltd is a specialized Real Estate Private Equity Investment Manager based in India. HDFC Capital has used an Engati bot in order to store registration details such as Name, Email id, etc. HDFC Capital deployed its solution on the WhatsApp Channel and integrated it with Google Sheets.

Tokio Marine

TMNF is one of the oldest and largest non-life Insurance companies across the globe. They have deployed an Engati bot to reduce their customer wait times and attend to customer queries coming from multiple channels. The bot has helped convert visitors to MQLs.

Moneyboxx

Moneyboxx Finance Limited is a BSE-listed, Non-Deposit taking, Non-Systemically Important Non-Banking Financial Company registered with the Reserve Bank of India (RBI). They have used an Engati bot for document verification and sending texts via WhatsApp. They use multilingual support, which has helped them enhance the communication with their users.

In conclusion.

The revolution with ai chatbots in banking has been incredibly phenomenal. Banking chatbots are providing excellent customer service and improving how customers interact with banks and other financial institutions. In fact, chatbots are revolutionising the way banks offer their services to customers.

Banks now put great effort into customer service since it has become a massive driver of customer satisfaction. It is necessary to rank ahead in the competition by providing outstanding products and services, brand recognition, trust, cost, and innovation.

With Engati, banks can build their own chatbot to automate a detailed and personalised experience for their customers. With the option between predefined chatbot templates and the ability to customise your chatbot from scratch, you can build the perfect financial chatbot with the features:

Artificial Intelligence and Machine Learning

Natural Language Processing

Omnichannel Inbox

Multi-channel access, including WhatsApp

And much, much more.

Build your conversational chatbot now!

.webp)

%20(1).webp)