Fun fact about Insurance -

Everybody needs it

In fact, people insure everything, from their business to health, amenities and even the future of their families after them.This makes insurance personal.

After all, people only want to invest in the best.

Another fun fact about Insurance -

It is dull and very complicated. Making it hard to understand. And nobody has that kind of time.

Therefore selling insurance policies is a game of providing the best options for customers in the most comprehensive manner, without wasting any time.

Moreover, technological advancements have transformed the insurance industry.With customers having faster access to unlimited information and virtual services, they can now shop for policies online, read reviews and compare policies offered by multiple insurance providers.

The options have increased and so has the competition.

One has to provide seamless, on-demand service while providing a personalized experience in order to keep a customer.

And for that, one has to transform with technology.Which is why insurers and insurtechs, worldwide, are investing in AI-powered insurance chatbots to perfect customer experience.

Consider this blog a guide to understanding the value of chatbots for insurance and why it is the best choice for improving customer experience and operational efficiency.

What is an Insurance Chatbot?

An insurance chatbot is an AI-powered virtual assistant that can be programmed to help ease the journey of insurance customers by catering to their requirements and improving communication between the insurance company and its consumer.

Statistics show that 44% of customers are comfortable using chatbots to make insurance claims and 43% prefer them to apply for insurance.

This is because chatbots use machine learning and natural language processing to hold real-time conversations with customers.

In turn providing:

- 24/7 customer service

- Meaningful interactions

- Faster resolutions

- Thorough processing

Which equals increased customer satisfaction.

What are the benefits of Insurance Chatbots?

.webp)

There are a lot of benefits to incorporating chatbots for insurance on both ends.

For one, chatbots help in making the complex simple. Chatbots are also easy to set up and are a one-time investment. They break down lengthy, complicated policy documents and bring in transparency and trust by answering all required and commonly asked questions, including estimating and providing price quotes and helping customers file for claims, all in real time. Instant satisfaction in customers triggers an increase in sales, giving the insurer the time and opportunity to focus on other facets to improve overall efficiency instead.

Simplification

Chatbots help simplify the complex. The long documents on insurance websites and even longer conversations with insurance agents can be endlessly complex. It can get hard to understand what is and is not covered, making it easy to miss out on important pointers. A chatbot easily breaks down this process for the customer. Starting from providing sufficient onboarding information, asking the right questions to collect data and provide better options and answering all frequent questions that customers ask.

24/7 Real-Time Service

Insurance in general is a 24/7 service industry. Since accidents don't happen during business hours, so can't their claims. Similarly, customer queries exist throughout. Having an insurance chatbot ensures that every question and claim gets a response in real time. A conversational AI can hold conversations, determine the customer's intent, offer product recommendations, initiate quote and even answer follow-up questions. This makes sure no customer is left unanswered and allows the customer to connect to a live agent if required, keeping customers satisfied at all times.

Streamlined Processes

Customers dread having to go through the tedious processes of filling out endless paperwork and going through the complicated claim filing and approval process. Chatbots cut down and streamline such processes, freeing customers of unnecessary paperwork and making the claim approval process faster and more comprehensive.

Employee Support

Chatbots are available 24/7 and allow companies to upload relevant documents and FAQ questions that are used to answer customer questions and engage them in real-time conversations. Chatbots also identify customers' intent, give recommendations and quotes, help customers compare plans and initiate claims. This takes out most of the unnecessary workload away from employees, letting them handle only the more complex queries for customers who opt for live chat. Most chatbot services also provide a one-view inbox, that allows insurers to keep track of all conversations with a customer in one chatbox. This helps understand customer queries better and lets multiple people handle one customer, without losing context.

Lead Generation

Chatbots feed on and respond to information. When in conversation with a chatbot, customers are required to provide some information in order to identify them and their intent. This information may start from the basic name, email and phone number and range all the way to more targeting details that help the chatbot determine the customer's requirements and propose necessary solutions for the same. They also automatically store this data in the company's data sheet for better reference. This helps not only generate leads but also sort them out on the basis of a customer's intent. AI Chatbots are always collecting more data to improve their output, making them the best conduit for generating leads.

Social Media Integration

Chatbots can be integrated across channels that consumers use every day. This keeps the business going everywhere and allows customers to engage with insurers as and when they grab their interest.

How can companies use Chatbots for Insurance?

There are a lot of benefits to Insurance chatbots, but the real question is how to use Chatbots for insurance.

Here are the top 5 use cases for insurance chatbots:

1. Educate customers and Answer FAQs

As already established, Insurance is a boring and complex topic that becomes hard to understand. Using an AI virtual assistant, the insurer can educate the customers by uploading documents with necessary information on products, policies and frequently asked questions (FAQs). Since AI Chatbots use natural language processing (NLP) to understand customers and hold proper conversations, they can register customer queries and give effective solutions in a personalised and seamless manner. For questions that are too complex and require human assistance, the chatbot can always suggest the option to connect with a live agent for better service.

2. Onboard new customers

An AI insurance chatbot is very helpful for guiding a new customer's onboarding process. From answering 'how to' questions so policyholders can update their address, pay bills and file for claims to helping them sign up for wellness programs and downloading their digital ID cards.

Chatbots also support an omnichannel service experience which enables customers to communicate with the insurer across various channels seamlessly, without having to reintroduce themselves. This also lets the insurer keep track of all customer conversations throughout their journey and improve their services accordingly.

3. Cross-selling and Upselling

Chatbots can leverage previously acquired information to predict and recommend insurance policies a customer is most likely to buy. The chatbot can then create a small window of opportunity through conversation to cross-sell and up-sell more products. Since Chatbots store customer data, it is convenient to use data based on a customer's intent and previously bought products with a higher probability of sale.

4. Claim Management

Originally, claim processing and settlement is a very complicated affair that can take over a month to complete.

It usually involves providers, adjusters, inspectors, agents and a lot of following up.

An insurance chatbot simplifies this entire process. Let your chatbot handle the paperwork for your policyholders, so all they are left with is informing the chatbot of the nature of the claim, providing additional required details and adding supporting documents. The bot finds the customer policy and automatically initiates the claim filing for them.

The chatbot will also assess the insurance type and the insured property/entity for its eligibility using provided media proof of the damage and using image recognition methods, to verify the damage while determining the liabilities.

5. Fraud detection

Fraudulent activities are a big problem in insurance companies. Stats have shown that such activities cause Insurance companies losses worth 80 billion dollars annually in the U.S alone.

Chatbots can use AI technology to thoroughly review claims, verify policy details and put them through a fraud detection algorithm before processing them with the bank to move forward with the claim settlement. This enables maximum security and assurance and protects insurance companies from all kinds of fraudulent attempts.

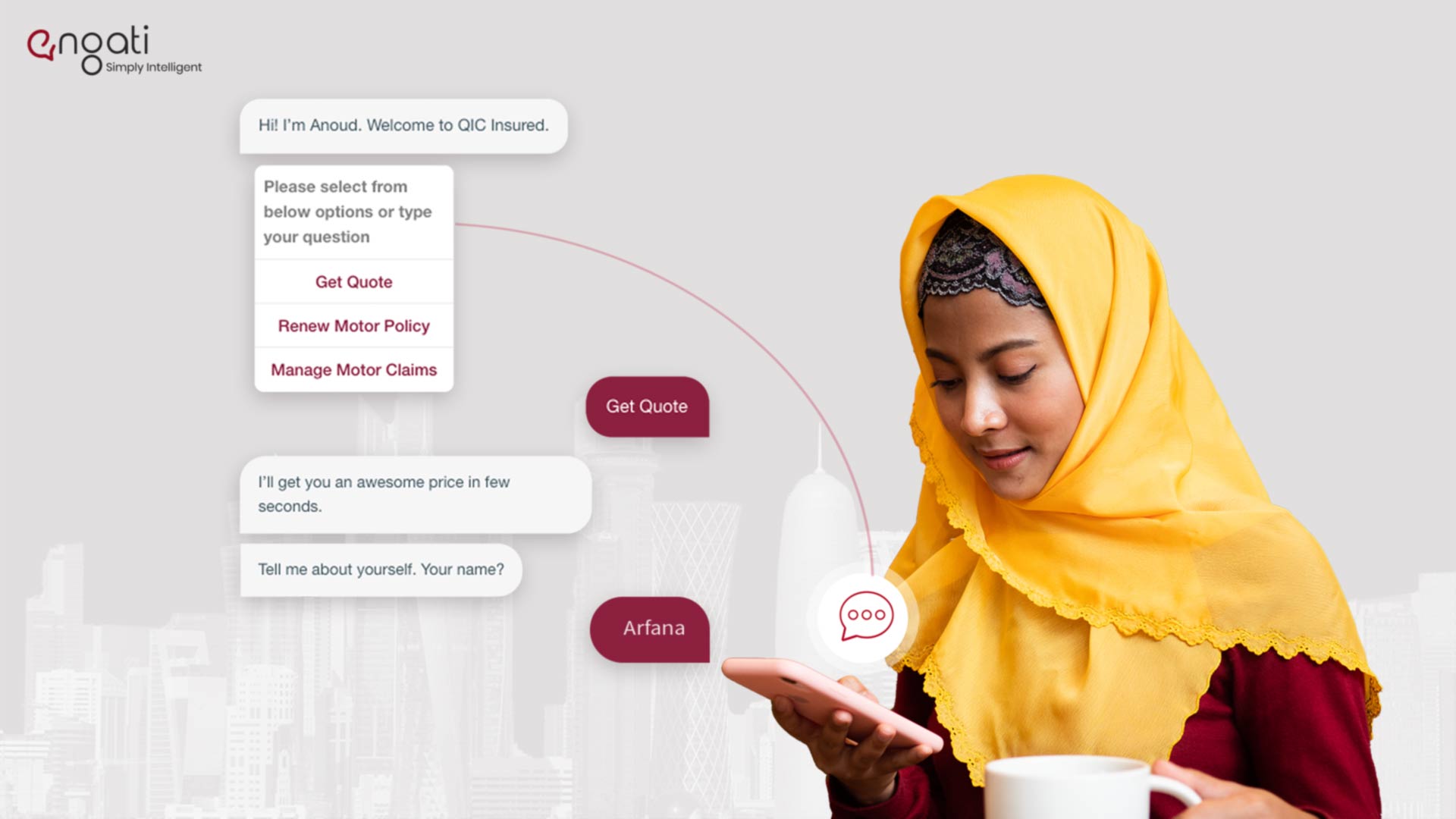

Here is a case study on how Qatar Insurance Company improved it's customer engagement using Engati's insurance chatbot.

Why use Engati's chatbot for Insurance?

1. Builds Customer satisfaction & trust

Engati provides efficient solutions and reduces the response time for each query, this helps build a better relationship with your customers. By resolving your customers’ queries, you can earn their trust and bring in loyal customers.

2. User responsive platform

Engati provides a user-friendly platform that is easily accessible and responsive across all devices. Our platform is easy to use, even for those without any technical knowledge. In case they get stuck, we also have our in-house experts to guide your customers through the process. You can efficiently build your own customized insurance bot with Engati.

3. Natural Language Processing Capabilities

With our new advanced features, you can enhance the communication experience with your customers. Our chatbot can understand natural language and provides contextual responses, this makes it easier to chat with your customers. Gradually, the chatbot can store and analyse data, and provide personalized recommendations to your customers.

4. Rich Analytics and support channels

Engati offers rich analytics for tracking the performance and also provides a variety of support channels, like live chat. These features are very essential to understand the performance of a particular campaign as well as to provide personalized assistance to customers.

5. eSenseGPT

With Engati’s eSenseGPT integration, you can answer a wide range of queries on the various policies, procedures, etc. You can resolve your customer queries within seconds, just by entering your data in our eSenseGPT and sharing a link to your website or Doc,or uploading a PDF Doc.

.png)

Future of Insurance Chatbots

There is no question that the use of Chatbots is only going to increase.

The COVID-19 pandemic accelerated the adoption of AI-driven chatbots as customer preferences moved away from physical conversations. As the digital industries grew, so did the need to incorporate chatbots in every sector.

By now, chatbots have become an integral part of numerous brands and services.

It has helped improve service and communication in the insurance sector and even given rise to insurtech. From improving reliability, security, connectivity and overall comprehension, AI technology has almost transformed the industry.

Therefore it is safe to say that the capabilities of insurance chatbots will only expand in the upcoming years. Our prediction is that in 2023, most chatbots will incorporate more developed AI technology, turning them from mediators to advisors. Insurance chatbots will soon be insurance voice assistants using smart speakers and will incorporate advanced technologies like blockchain and IoT(internet of things). Insurance will become even more accessible with smoother customer service and improved options, giving rise to new use cases and insurance products that will truly change how we look at insurance.

That said, AI technology and chatbots have already revolutionised the chatbot industry, making life easier for customers and insurers alike. Many automation and chatbot providing companies have come into play. Engati is the best example of a chatbot service provider that helps your business build and run its own insurance chatbot on various channels including WhatsApp and lets insurers maintain track of every conversation across channels with its omnichannel feature, along with many other automation features.

You can always schedule a demo or continue on to read about How to use WhatsApp chatbots for Insurance.

%20(1).webp)